Most business owners would agree that controlling overhead costs is critical, but often struggle to optimize operating budgets. A yearly average or a rolling quarterly analysis can provide a more accurate picture. If your company offers diverse products or services, you must tweak your CRR formula accordingly. You will then understand which offerings are more cost-effective and profitable.

Operating vs. Non-Operating Expenses

This means that for every dollar of revenue generated, the company spends 50 cents on expenses. Therefore, it is necessary to track the trend of this crucial ratio regularly. Whenever there is a significant deviation from standard industry performance ratios, it is critical to investigate why the business is not performing as expected and proactively set corrective measures. Industry benchmarks typically vary widely according to sector and business size, which means that businesses need to evaluate their ratios in the context of their operational models.

How the Expense to Revenue Ratio Impacts Profitability

- (!) Remember, SalesNash specializes in lead generation and appointment setting, offering an effective solution for outsourcing outbound efforts.

- This can be achieved through various strategies such as reducing unnecessary expenses, increasing operational efficiency, improving pricing structures, or expanding revenue streams.

- To calculate it, divide the cost of goods sold (COGS) by your total revenue.

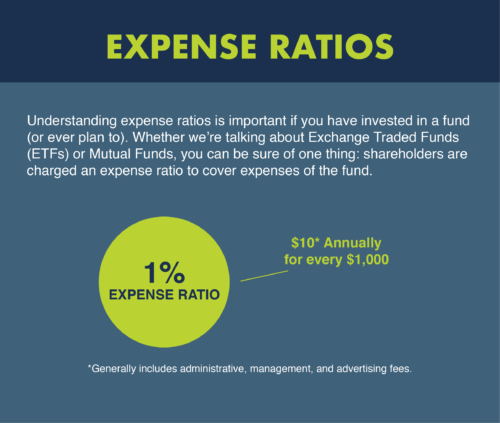

- Depending on the type of fund you’re investing in, expense ratios can vary greatly.

Distribution and service fees, also known as 12b-1 fees, are fees charged by some funds for marketing and distribution purposes. These fees are intended to cover the costs of promoting the fund, attracting new investors, and maintaining existing investors. Compare the above to an index fund with a 0.03 percent fee, which would result in a charge of $300 on your $1 million portfolio. Indeed, fees can greatly affect returns, so it’s important not to ignore them. When charged as a percentage, fees eat up a larger and larger amount of money as your portfolio balance grows.

Gross Expense Ratio

Comparing ratios across different reporting periods shows how a company is performing, which helps identify areas for improvement. By analyzing the historical data, businesses can better understand the drivers of their costs and revenue, predict short-term accept payments with cash app pay trends, and set realistic goals for the future. The operating expense ratio measures a company’s operating expenses as a percentage of net sales. It gives insight into how efficiently a company is managing costs and generating profits.

Investing in JPMorgan Nasdaq Equity Premium Income ETF (JEPQ) FAQs

In simpler terms, it’s all about keeping your spending in check, ensuring you’re not bleeding money left and right. Supply chain management software can help automate inventory management processes by ordering raw materials only what is needed and making production adjustments based on demand. By using technology to manage cost and revenue, businesses can improve their operations’ efficiency, streamline processes, and identify optimization opportunities. It’s a goldmine of data, and you can use it to improve your profit margin and cost to revenue ratio. You can improve your cost to revenue ratio and enjoy profits by reducing costs and increasing revenue. The expense ratio of a fund or ETF is important because it lets an investor know how much they pay to invest in a specific fund and how much their returns will be reduced.

Formula

Administrative expenses cover the costs related to the day-to-day operations of an investment, such as recordkeeping, legal, and accounting services. These expenses vary depending on the size and complexity of the investment. The expense ratio refers to the percentage of an investment’s assets that are used to cover the ongoing expenses related to the management and administration of that investment. This return ratio reflects how well a company puts its capital from all sources (including bondholders and shareholders) to work to generate a return for those investors. It’s considered a more advanced metric than ROE because it involves more than just shareholder equity—it considers all the capital that is being used by the company to generate the profits. The cash flow margin measures how well a company converts sales revenue to cash.

Also, any trading activities in the fund are not included in this calculation. Charlene Rhinehart is a CPA , CFE, chair of an Illinois CPA Society committee, and has a degree in accounting and finance from DePaul University. Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master’s in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses.

Times interest earned (TIE) is an indication of a company’s ability to meet debt payments. Divide earnings before interest and taxes, or EBIT, by total annual interest expenses and get the times interest earned ratio. The following financial ratios are derived from common income statements and used to compare different companies within the same industry.

Marketers can optimize campaigns, sales leaders can make informed decisions, and founders can have a financial dashboard for strategic decision-making. This JPMorgan ETF has an expense ratio of 0.35%, or $35 per $10,000 invested annually. This rate is considered very affordable for an actively managed ETF that involves complex strategies such as using derivatives.

However, what is considered “good” can vary, and it’s essential to compare ratios with industry benchmarks and historical performance for a more accurate assessment. One way to understand the company’s performance in terms of cost of sales to revenue ratio is to analyze historical data. By tracking performance over time, businesses can identify trends, predict future performance, and adjust operations accordingly.

For example, the manufacturing industry may have a higher cost of sales to revenue ratio than the service industry. It is essential for businesses to understand their industry’s benchmark for this ratio to make more informed decisions for their operations. Although both companies have the same 20% expense ratio, Company B is less efficient as it is generating less sales revenue relative to operating expenses. Tracking this metric over time and comparing to industry benchmarks helps assess operational efficiency and cost management. Taking steps to streamline operations or cut unnecessary spending can help improve profitability.